The professionals for construction andrelated trades

The professionals for construction and

related trades

The professionals for logistics /Fleet Solutions / Transport

The professionals for logistics /

Fleet Solutions / Transport

The professionals for productionand trade

The professionals for production

and trade

credit insurance

Why credit insurance?

- A credit insurance minimizes the economic risk of companies,by insuring businesses on open account with customers at home and abroad. It assists the companies with the current creditworthiness checks of their clients, the credit management and pays the loan default in the event of damage. If you look at the assets of the balance sheet of a company, in the vast majority of cases, loans and advances are uninsured. As soon as a part of this gets lost, due to insolvency, it can cause many consequences. A credit insurance protects from this hazard.

For which companies are credit insurances necessary?

- Firms with industrial and trade clients and which are delivering on open account. With a credit insurance, claims of good delivery, services as well as projects can be insured.

What speaks in favour of credit insurances?

- Every third insolvency results from their previous insolvency

- The number of insolvency is increasing

- The claims record of credit insurance is up to 90%

- To protect the turnover

Our tasks:

- To negotiate the best conditions at the change of insurer

- Persistent verification and maintenance of the contracts

- Competent claims management

Your benefit:

- Avoidance/reduction of loan default

- Support with the credit management

- Securing the liquidity and the current assets

- Calculability of the economic risk

- Expansion of the present relation with clients

- Opening up for new markets and clients

- Support with the sales control

- Fast compensation payment in the case of damage

D & O - insurance

Due to the legal regulation in AktG and GmbHG, the organs of a joint stock company are personal liable towards the company and thirds. Furthermore, there is shift in the burden of proof, an attitude of solidarity and unlimited liability with the private property. Compliance rules and the „Corporate-Governance-Codex“ intensify the liability situation too. Only an extensive insurance cover with few exclusions protects the private property and fends off unjustified claims. Favourable is a firm cover (the company is policyholder), only if this is not possible, a personal D&O insurance could be taken out. In many cases (insurance premium, amount insured and conditions), this insurance is only known as an alternative or rather second best cover.

Beside the liability insurance(D&O) are legal costs insurances (penalty, property damage and contract of employment) a „must-have" for the cover of management risks. .

On the market are many conditions offered. Most of these conditions contain lots of cover restrictions and exclusions, which don`t fulfill the expectations of the insured organs.

To protect the D&0 legal liability risk of the insured organs, we got help from a specialist. This specialist developed his own terms and conditions, which offer considerable benefits against the known on the existing market.

Our achievements:

- To analyse the liability risk in companies

- Tenders by our cooperation partner on the insurance market, on the base of leading terms and conditions throughout the European Insurance market

Your benefit:

- 100% protection of your personal liability

- Absolute safety due to leading terms and conditions

- On account of the international nature of our provider, we can guarantee the best possible insurance premiums

Cyber risk insurance

Due to current events, we want to inform you that the chamber of economy offers rapid first aid in case of a cyber-attack for its members. You receive free emergency help as well as recommendations for a free initial meeting with an IT- security company nearby under 0800 888 133, 7 days a week, from 0 to 24 o`clock.

WKO, Link: www.wko.at/Content.Node/kampagnen/cyber-security-hotline/index.html

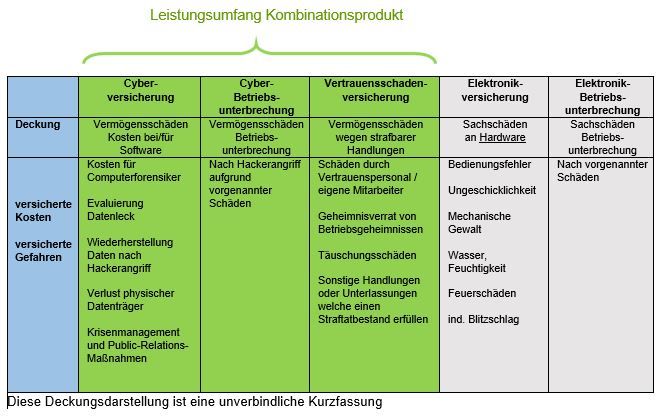

On account of the growing digitalization, the risk of a cyber- attack is increasing too, disregarding the size of the company or line of business. The insurance market offers more and more extensive solutions, also in the form of combination products (cyber- , cyber interruption of business – and damage caused by breach of contract- insurance). A complete package like this is appropriate to receive the complete insurance cover in cyber criminality.

On the one hand, there is insurance cover against claims from thirds in connection with data influence, data misuse and violation against regulation of the data protection. On the other hand insurance against own damages and costs for data extortion, infringement of information security as well as injuries because of criminal acts by a close confidant like an employee. For companies up to € 100 mio. turnover and positive answering of few risk questions (7 questions), are reasonable insurance premiums possible. Please do not hesitate to contact us for any further information.

Another important information is that no property and liability insurance pays for all kinds of damage from cybercrime currently.

Adress

Wokatsch-Felber Versicherungsmakler GmbH

Ardaggerstrasse 15

3300 Amstetten

Opening hours

Monday to Thursday from 07:30 am to 4:30 pm

Friday from 07:30 am to 01:00 pm